The title of the youngest billionaires in the world continues to change as new wealth is created at a record pace.

In recent years, younger individuals have entered the billionaire ranks through a mix of entrepreneurship, inheritance, and rapid business growth. These billionaires are often founders of tech startups, heirs to family fortunes, or early investors in thriving sectors.

Their stories reveal how age is no longer a barrier to extraordinary wealth. This article highlights the top 10 youngest billionaires and explains how each reached billionaire status.

Clemente Del Vecchio

Clemente Del Vecchio is the world’s youngest billionaire, inheriting his fortune from his late father, Leonardo Del Vecchio.

As a shareholder in Delfin, the holding company behind eyewear brands like Ray-Ban and Oakley, his wealth is tied to Luxottica’s success.

He owns substantial equity in major European business ventures. Though not active in management, his net worth has exceeded four billion dollars. Clemente represents the new generation of passive billionaire stakeholders.

Current Role and Influence

Clemente remains a private individual, rarely appearing in the media. Despite holding significant assets, he has not assumed operational responsibilities. His role remains that of a passive beneficiary, although his equity gives him long-term influence.

It is unclear whether he intends to step into leadership roles in the future. His current focus appears to be on managing his inherited portfolio.

Kim Jung-youn

Kim Jung-youn amassed her wealth through NXC Corporation, which owns Nexon, one of South Korea’s leading gaming companies.

She became a billionaire after inheriting shares following her father’s death. Her net worth quickly rose due to the company’s dominance in the Asian gaming market.

Despite the scale of her wealth, Kim avoids public appearances. She continues to focus on her private life while holding massive influence through corporate equity.

Impact on Nexon and Future Plans

While Kim does not currently serve in a public leadership capacity, her ownership still matters in board decisions. Her presence signals continuity in the company’s long-term vision.

It’s unclear if she will become more involved operationally. What’s certain is that her position ensures financial and strategic power. Her future choices could shape Nexon’s governance.

Kevin David Lehmann

Kevin David Lehmann became a billionaire after receiving a 50 percent stake in Germany’s dm-drogerie markt.

His father transferred the shares when Kevin turned 18. Although he plays no public role in the business, his wealth has remained steady due to the chain’s profitability.

His net worth exceeds two billion dollars as of 2025. Kevin maintains a quiet profile and lives in Germany.

Relationship with the Family Business

Despite being a major stakeholder, Kevin does not involve himself in day-to-day operations. His father had previously been the silent partner, and Kevin continues this legacy.

The chain continues to thrive across Germany and other parts of Europe. Kevin’s investment is proof of the stability of family-owned retail operations. His fortune is a testament to generational wealth preservation.

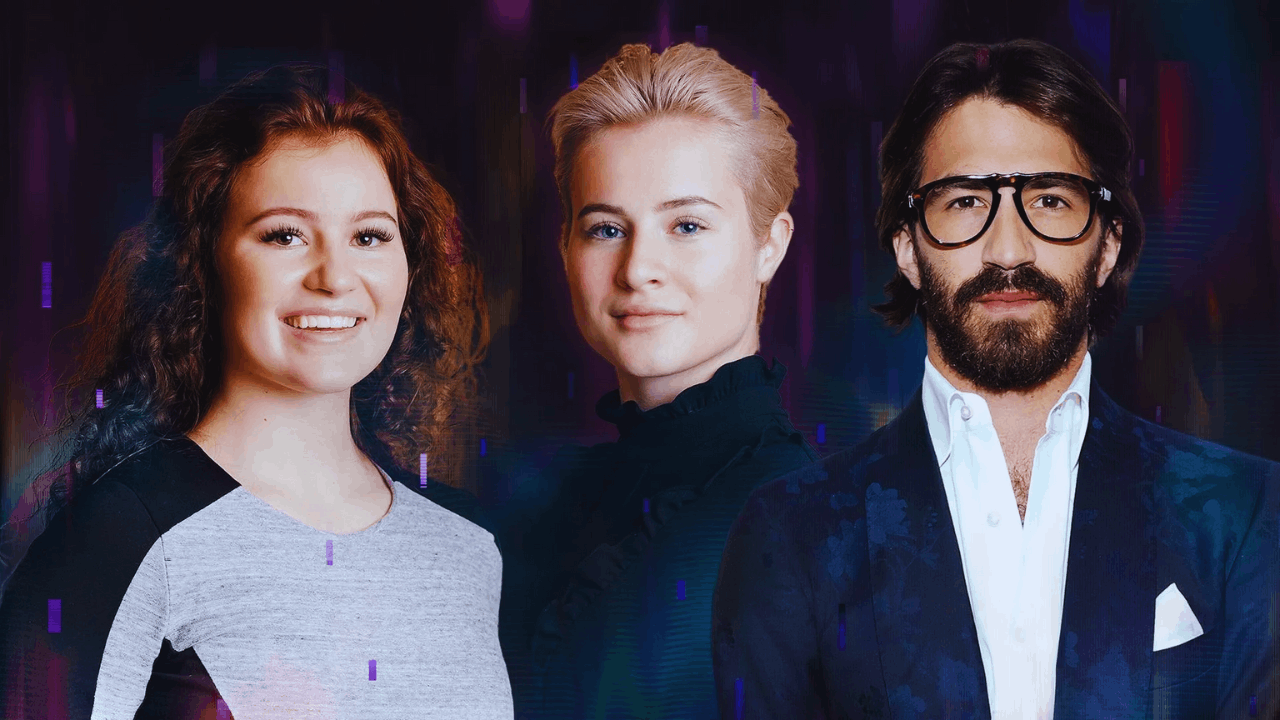

Alexandra Andresen

Alexandra Andresen entered the billionaire list at age 19 after inheriting shares in Ferd, a Norwegian investment company.

She is known for her involvement in equestrian sports and environmental causes. Ferd's strong financial performance has preserved her position among the richest young individuals.

She continues to be engaged in philanthropy and sports. Her billionaire status stems from a well-structured transfer of assets from her family.

Interests Beyond Business

Alexandra often shares her interest in equestrian competitions and environmental activism. While she holds influence in Ferd through equity, she focuses on charitable efforts.

She brings public awareness to social issues in Norway. Her presence on the billionaire list blends financial strength with public-minded engagement. Alexandra is one of the few heirs publicly active in civil causes.

Katharina Andresen

Katharina Andresen shares a similar background with her younger sister Alexandra, both inheriting large stakes in Ferd.

Her financial rise mirrored her sibling’s, with an equal share in the family investment firm. She participates in select public initiatives focused on sustainability.

Her estimated net worth places her firmly in the global young billionaire class. Katharina’s influence grows through her ties to corporate governance and advocacy.

Position in Ferd and Public Role

Katharina is less publicly visible than Alexandra but remains influential within Ferd. She plays a more reserved role, focusing on strategic investments and internal affairs.

Her leadership influence is more pronounced in governance-related areas. She also contributes to Ferd’s corporate responsibility programs. Her billionaire identity is tied closely to long-term investment stability.

Wang Zelong

Wang Zelong inherited wealth linked to a Chinese company producing titanium dioxide.

This material is essential in manufacturing coatings, plastics, and other industrial products. His stake in the business is valued in the billions, putting him among China’s richest young individuals.

Despite his position, Wang rarely engages with the media. His fortune reflects industrial wealth passed down in China’s growing economy.

Business Reach and Discretion

The company Wang is tied to has international operations and industrial partners. His inherited equity connects him with high-demand manufacturing sectors. Despite the exposure, Wang chooses to remain behind the scenes.

His discreet nature aligns with many wealthy individuals in China. His case shows that industrial wealth can remain out of the spotlight.

Ryan Breslow

Ryan Breslow made his mark by founding Bolt, a U.S.-based payment platform that simplifies online transactions.

He became a billionaire following major investment rounds that dramatically increased the company’s valuation. Known for challenging corporate norms, Ryan also leads wellness initiatives through Love.com.

His fortune was built on fintech disruption and product-market fit. He continues to develop solutions that influence both finance and consumer behavior.

Startup Culture and Vision

Breslow is known for building a company culture focused on transparency and well-being. He made headlines for implementing a four-day workweek for Bolt. His leadership style contrasts with many traditional corporate structures.

Breslow uses his platform to advocate for conscious entrepreneurship. He aims to inspire future startup founders to combine performance with purpose.

Palmer Luckey

Palmer Luckey created Oculus VR and sold it to Facebook for over two billion dollars while in his twenties.

This deal launched his name into global recognition. Later, he founded Anduril, a defense tech firm focused on AI-powered systems. His ventures continue to secure large government contracts, growing his wealth steadily.

Palmer represents young entrepreneurs who succeed by innovating in emerging sectors.

New Ventures and Public Views

Luckey is outspoken in political and defense circles. He is also deeply involved in national security innovation through Anduril.

His position in the defense sector gives him significant influence beyond Silicon Valley. Palmer blends entrepreneurship with geopolitical relevance. His work shows that billionaire impact extends well beyond commerce.

Austin Russell

Austin Russell launched Luminar Technologies, specializing in lidar sensors for self-driving vehicles.

He entered the billionaire club when the company went public in a high-profile deal. His leadership and technical knowledge propelled Luminar into partnerships with top automakers.

Today, his net worth remains strong due to long-term demand for mobility innovation. Austin is recognized as a major figure in the future of transportation tech.

Company Goals and Market Position

Russell aims to make self-driving cars safer through precision sensor technology. Global automotive leaders use his company’s products.

Luminar continues to lead the lidar space with patents and custom platforms. Russell’s focus is long-term deployment over short-term hype. His pragmatic approach makes him one of the most grounded tech billionaires.

Pedro Franceschi

Pedro Franceschi co-founded Brex, a fintech company offering credit and financial tools for startups.

His rise began in his teenage years when he moved to the U.S. to pursue tech opportunities. As Brex grew, so did its share value, pushing it into billionaire territory.

He remains active in product development and expansion strategy. Pedro symbolizes the new wave of immigrant-led startups reshaping finance.

Cultural Identity and Business Drive

Pedro’s story is one of cross-border ambition. He highlights how Latin American entrepreneurs are rising in the U.S. tech scene.

His leadership at Brex combines tech innovation with financial accessibility. Pedro also speaks on diversity and inclusion in tech. His influence is expanding as Brex scales internationally.

Conclusion

The stories of the youngest billionaires in the world showcase a generation that has either built or inherited immense wealth before reaching the age of 35.

Some have capitalized on cutting-edge technology, launched fintech innovations, or reshaped industries like virtual reality and autonomous driving.