Billionaires approach investing differently than most. They aren’t driven by short-term speculation or media hype. Instead, they prioritize long-term value, control, and strategies that preserve their capital across generations.

This article explores the top three investments that billionaires love. Each asset class is selected not just for its potential returns, but for the strategic advantages it offers in terms of flexibility, influence, and legacy.

Understanding how billionaires think about investing can help anyone become a smarter and more disciplined investor.

Real Estate

Real estate plays a foundational role in the portfolios of billionaires. Its physical nature provides a sense of permanence and security that aligns with legacy wealth goals.

Whether through commercial towers, luxury estates, farmland, or industrial holdings, real estate offers a blend of value appreciation, passive income, and tax benefits.

Long-Term Value Growth

Billionaires invest in properties located in economically resilient cities and limited-supply areas.

These markets consistently appreciate over time due to population growth, infrastructure expansion, and scarcity. Prime locations in cities like London, New York, and Singapore become increasingly valuable as demand rises and available land becomes scarce.

For billionaires, holding onto these assets means steady appreciation and long-term preservation of value.

Income and Financing

Rental income adds a consistent revenue stream to billionaire portfolios. Commercial leases, residential rentals, and hotel operations generate predictable cash flows.

These earnings support day-to-day liquidity without the need to sell assets. In addition, real estate can be used as collateral to access loans or credit lines.

This allows billionaires to unlock capital for new investments without giving up ownership of the underlying property.

Control and Security

Owning real estate allows billionaires to retain full control over their assets. They can redevelop, refinance, or hold indefinitely. These assets also provide security, not just financially, but personally.

Private estates and secure commercial buildings offer privacy and protection. For many, real estate serves not only as an investment but also as a strategic physical presence in key markets.

Private Equity

Private equity is one of the most powerful wealth-building tools for billionaires. It enables them to participate in the growth and management of private companies directly.

Unlike public stocks, private equity provides a deeper level of ownership and influence that appeals to investors who want more than just returns.

Company Growth

Billionaires often invest in businesses with strong potential for expansion. Through private equity, they partner with entrepreneurs and management teams to scale operations, enter new markets, and improve profitability.

These relationships can last years and are built on mutual strategic goals. By taking board seats or acting as advisors, billionaires help guide these companies toward sustained growth.

High Return Potential

While private equity is less liquid than other assets, it frequently offers higher returns. Investors are rewarded for their patience and involvement.

Billionaires gain access to early-stage companies, buyouts, and industry-specific ventures with strong upside potential.

Their capital and networks increase the odds of success, making this asset class one of the most lucrative in long-term wealth building.

Portfolio Stability

Because private equity investments are not priced daily like public stocks, they are less susceptible to short-term market fluctuations.

This stability makes them a valuable counterbalance in a diversified portfolio. Billionaires utilize private equity to mitigate volatility and gain long-duration exposure to industries they are familiar with and trust.

Public Stocks

Public equities remain essential in billionaire portfolios for their liquidity, transparency, and global reach.

Through the stock market, billionaires can own shares in the most influential companies on the planet.

This exposure allows them to participate in the growth of innovation-driven businesses across all sectors.

Market Leaders

Billionaires typically invest in companies with proven track records, dominant market positions, and scalable models.

Firms like Apple, Microsoft, Amazon, and Google are common holdings. These companies consistently generate earnings and have high barriers to entry.

By investing in global leaders, billionaires reduce risk while maintaining exposure to economic growth.

Ownership and Influence

Unlike retail investors, billionaires often take large enough positions to influence corporate governance.

They may be invited to join boards or meet with CEOs to discuss strategy. Their presence as major shareholders gives them leverage in decisions about mergers, restructuring, or capital deployment.

This level of influence adds another layer of value beyond financial returns.

Flexibility

Public stocks offer the flexibility to move capital quickly. In contrast to real estate or private equity, which require long holding periods, equities can be sold on short notice.

This allows billionaires to rebalance portfolios, capitalize on opportunities, or raise cash for other investments. Liquidity is a key reason why public markets remain central to wealth management strategies.

Additional Advantages

Real estate, private equity, and public stocks also serve important purposes beyond financial returns. There are so many advantages that offer better returns and contribute to their wealth.

For billionaires, these investments provide tax planning tools, legacy structuring, and philanthropic leverage. They are part of an integrated wealth ecosystem that supports both current income and future goals.

Tax Planning

Each of these asset classes offers unique tax advantages. Real estate can be depreciated and exchanged under favorable tax codes.

Private equity gains may qualify for long-term capital treatment and can be structured through partnerships to reduce liability.

Public stocks can be transferred to charitable foundations or trusts to minimize estate taxes. These features are essential in preserving wealth over time.

Long-Term Impact

Billionaires use these investments to build legacies. Properties become family holdings. Businesses can be passed to children or sold for charitable purposes.

Stocks may fund endowments or global initiatives. The structure of these assets supports flexible planning that aligns with personal values, family interests, and global impact objectives.

Why These Investments Matter

Real estate, private equity, and stocks represent the pillars of billionaire portfolios because they work together to create a comprehensive investment strategy.

Each has different strengths, but together they provide balance, growth, and security.

Key Benefits

Real estate delivers steady appreciation and income. Private equity enables high-growth ownership and operational influence.

Stocks offer liquidity and exposure to innovation. This combination creates a foundation that performs across economic conditions and market cycles.

Billionaires aren’t just picking random assets—they are building systems that preserve wealth for generations.

Strategic Diversification

Diversification is not just about spreading money across sectors—it’s about aligning different types of assets to reduce overall risk.

Real estate covers hard assets. Private equity captures business growth. Stocks provide public exposure. When combined strategically, they create a portfolio that withstands disruption, adapts to change, and grows consistently.

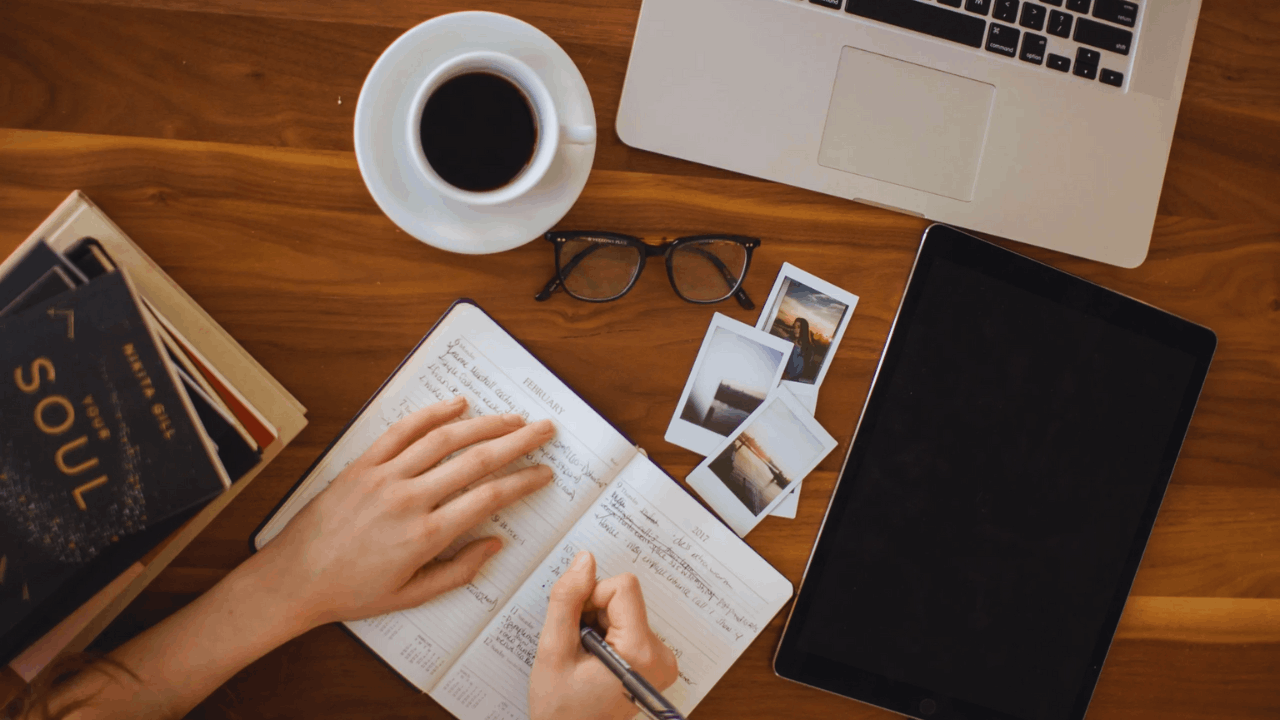

What Investors Can Learn

You don’t need billions to apply the same principles. These investment strategies are scalable, accessible, and actionable for individuals at many income levels.

What matters is the mindset, discipline, and planning behind the decisions.

Start by focusing on assets that hold intrinsic value. Invest in real estate for a steady income and financial security. Explore business partnerships or equity crowdfunding for private equity exposure.

Build a diversified stock portfolio with a long-term horizon. Avoid chasing fast returns. Instead, commit to consistent growth through quality assets.

Education and Research

Education and research are critical. Billionaires don’t rely on guesswork—they surround themselves with experts, advisors, and analysts.

Every day, investors can do the same by working with financial planners, reading industry reports, and learning about the performance of different assets.

With the right guidance, it’s possible to build a portfolio that reflects the same strategies used by the world’s wealthiest individuals.

Conclusion

Billionaires do not leave wealth creation to chance. Their investment decisions are rooted in experience, analysis, and long-term planning.

By understanding how these assets function and why they are favored, investors at all levels can make more informed decisions. Investing like a billionaire means thinking like one: be patient, be strategic, and focus on value.